Position Size Calculator

I am the Director/Owner of Excel Markets Inc. (Regulated by the US National Futures Association)

I am an NFA Associate Member with a Series 3 and 34 license.

Having previously worked with multiple CFD brokers in Cyprus, I maintain a strong commitment to staying current with industry trends. My analytical skills are pivotal in recommending tailored trading solutions that align with clients' specific needs and investor profiles.

Data is continually updated by our staff and systems.

Last updated: 06 Jan 2026

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

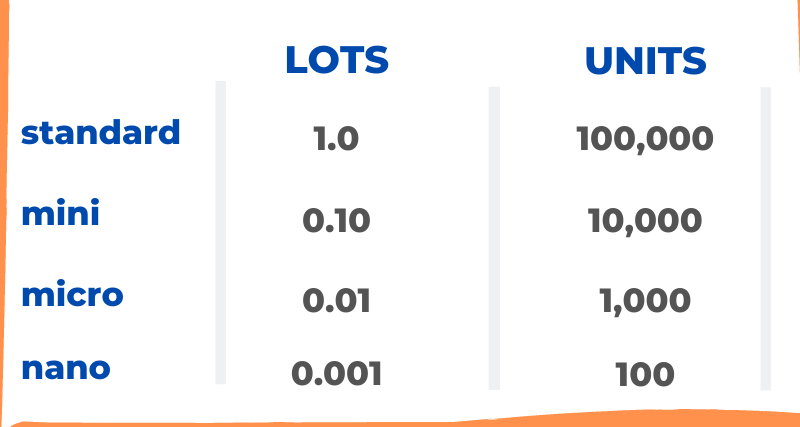

Read more about us ⇾Units per 1 lot vary on non-forex pairs, please check with your broker

In MT4 and MT5 right click a symbol and then click Specification. The Contract Size field tells how many units are in one lot.

View image

View image

What are Lots in Forex

A lot in forex defines the position size, or, the trade size. It is the number of currency units to be sold or bought in a trade. In forex trading 1 standard lot equals to 100,000 units of the base currency. For example, when an investor enters a long 1 lot EUR/USD trade, he/she is buying 100,000 units of the Euro (base currency) versus the USD (counter currency).

Several retail forex brokers also offer FX trading with fractional lot sizes; from 0.99 down to 0.10 (mini lots). In an attempt to popularize currencies trading, and attract new business, other retail brokers also offer smaller trade sizes, 0.01 (mini lots) and even 0.001 (nano lots).

Check out the image above to compare the common trade sizes and respective currency units.

Our Position Size Calculator is powered by CBFX trading tools.