What is Forex and How Does it Work

Data is continually updated by our staff and systems.

Last updated: 21 Jan 2021

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾

Forex is an acronym for the foreign exchange market, where one currency is exchanged for another. Forex is used worldwide, between banks, businesses and by normal people while going abroad or on holidays.

Table of Contents

- Forex is a 24/5 market, running from Sunday evening until Friday evening

- Forex is a global market, completely decentralized

- Forex is the most liquid financial market in the world with a daily volume of 5 trillion USD per day

- Currencies are traded by businesses, central banks, institutional and financial companies. Lately, is also a very popular market with speculators and retail traders

What is Forex Trading

Forex (or FX) is an acronym for the foreign exchange market or currency market, where currencies from different countries are valued and exchanged. The exchange rate is determined by the laws of supply and demand.

Forex trading is the definition used to describe an individual or an institution buying one currency and selling another in a simultaneous transaction.

Currency trading always occurs in pairs where one currency is sold for another and is represented in the following notation: EUR/USD (selling Euro and buying US dollars) or USD/JPY (selling US dollars and buying Japanese Yen). Try the currency converter tool below to get the latest exchange rates.

Forex trading volumes are created daily by all types of market participants. From businesses exchanging one country currency for another to pay for goods or services, to individuals simply speculating the market rates. But the large volumes in Forex trading are generated mainly by institutional and financial entities such as banks and investments firms.

The majority of the daily volumes in Forex trading occurs between the currencies of the main global economies, defined in Forex, as the majors. Major currencies pairs include the Euro, the UK pound, Australian, Canadian, New Zealand and US dollar, the Swiss franc and the Japanese Yen.

Minor currency pairs do not include the US dollar in the price quote, still, minor pairs are quite liquid and also widely traded. A couple of examples of the minor pairs are the AUD/CHF or the GBP/NZD.

The exotic currency pairs include the currency of an emerging economy country such as the EUR/MXN (Mexican Peso) or the USD/BRL (Brazilian Real). In Forex trading the exotic pairs are less liquid resulting in higher transaction costs.

How is Forex Trading Measured?

Currency pairs quotes fluctuate throughout the trading session. They are subject mainly to the supply and demand rules, a direct consequence of a country’s economic situation or outlook.

If a country is releasing positive economic news and forecasts, then, in principle, that country’s currency should appreciate against its peers.

Currency trading is much more than waiting for a better rate to exchange the remaining 20 US dollars from your holiday back into UK pounds.

Forex trading is selling, or buying, large amounts of one currency for another. These amounts are measured in lots, which defines the trade size, or the number of currency units to be bought or sold in a trade. One standard lot in Forex is 100,000 units of the base currency.

Forex Trading Sessions, Key Players and Measurements

Forex is a decentralized marketplace, meaning there isn’t a global regulator to oversee all the market activities. It is also a global market open for business 24/5, from Sunday evening to Friday evening. How is it possible that a market is open 24 hours?

Well, a Forex daily trading session is in reality the joining of the 3 main global sessions: Asia, Europe and North America. When the closing bell arrives for the New York session, the last main financial hub open during a Forex trading day, Sydney, in Australia, opens for business.

Then, liquidity increases a couple of hours later when Tokyo joins in. And one hour before the Tokyo session closing time, Frankfurt in Germany opens, with London joining in one hour later. By the time Europeans are having lunch, New York opens and joins the global FX markets, running alongside with the London session. These two sessions combined represent over 50.7% of the global traded FX volume.

The key players in FX trading are the central banks, commercial banks, financial institutions and corporations, controlling huge volumes and supplying liquidity to the market. Less important, regarding the much lower volumes, but by far the largest slice of market participants, are the individuals, referred to as retail investors.

With the advent of technology and the proliferation of FX brokers, this market is now open to anyone. Millions of retail investors try their trading skills, and unlike professional traders with 6 screens or more in front, several thousand retail investors trade on the go with some of the best Forex trading apps, straight from their smartphones!

The price fluctuations in Forex trading are measured in pips. A pip, short abbreviation for “percentage in point” or “price interest point”, is the smallest price move a currency pair can make. The pip measurement is also used by the FX retail brokers to mark up their profit. When you hear that a broker has a EUR/USD spread of 1 pip, this means that the difference between the buy price and the sell price is 1 pip.

For example, the EUR/USD ask price is offered at 1.2119 and the bid price at 1.2118. The difference, 1 pip, is the broker spread.

What Exactly is Traded in Forex?

Forex trading is not a paper stock or a physical commodity. It is cold hard cash. More accurately, FX online trading is bits of data that represent a tangible currency. However, it is not a single currency you are buying or selling, but rather you are trading one country’s currency against the other. This unique interaction results in currency being traded in pairs.

For example, the Euro can be traded against the UK pound, and thus you can buy a currency pair of EUR/GBP that represents how many British pounds one Euro is worth. There are hundreds of currencies throughout the world (many of which are tradable), but there are several key currencies and pairs which account for the majority of Forex volume:

| Popular Currencies | Traded Volumes | Popular Pairs | Traded Percentage |

|---|---|---|---|

| US Dollar (USD) | 86.30% | ||

| Euro (EUR) | 37% | EUR/USD | 28% |

| Japanese Yen (JPY) | 16.5% | USD/JPY | 17% |

| British Pound (GBP) | 15 % | GBP/USD | 14% |

| Swiss Franc (CHF) | 6.8% | USD/CHF | 4% |

| Australian Dollar (AUD) | 6.7% | AUD/USD | 5% |

| Canadian Dollar (CAD) | 4.2% | USD/CAD | 4% |

Source: Bank for International Settlements (BIS) Triennial survey (www.bis.org) | |||

Who Trades Forex?

With over US$5 trillion daily trading volume, Forex is the largest market in the world, many times bigger than all the world stock and futures markets combined. Not long ago it was the exclusive domain of central and commercial banks, global business corporations and financial firms. These same big players still comprise the bulk of all daily trading volume, but the market has changed.

The financial deregulation of the 1990s, coupled with new internet-based technologies, led to the creation of several FX brokers aimed at facilitating the trading to the retail investors. These same brokers are the revolving door, offering pools of liquidity supplied by the big banks and enabling retail traders to access the huge speculative opportunities presented in Forex trading.

Traders, big and small, have been growing in numbers and volume in order to take advantage of small fluctuations in exchange rates for the purpose of speculation and profit. We discuss about the growth of Forex and its market participants in the article Who Trades the Forex Market and Why.

What are the Types of Forex Markets?

The three potential markets for a Forex investor to trade currencies are the spot market, the currency futures market, and the currency forward market.

What is the Forex Spot Market?

The Forex spot market is currently the largest OTC market for currency exchange. The spot market is where currencies are bought and sold instantly at their current price at an agreed-upon exchange rate. These exchanges and the liquidity are typically facilitated either by a broker or a bank, and most of all retail traders will only trade in the spot market.

In a typical spot retail transaction, we will see the current exchange rate of the EUR/USD, quoted by the broker platform as 1.2119 ask price, for instance. We will buy at market price $1000 of it (1 micro lot) instantly at the quoted ask price with the click of a button, minus a small spread or commission cost, and sell it minutes later for a profit or loss, calculated in pips and dollars.

We might only have $1000 in our account, but because the typical Forex broker gives us 100:1 leverage, we only need $10 margin in our account to trade that $1000 micro lot size.

Where is the Spot Forex Market Traded?

Forex does not have a physical site, that is, there is no big building like the New York Stock Exchange on Wall Street or the Chicago Board of Trade in Chicago where a bunch of people on the floor or “pit” yell, hand-signal or waive dollar bills to conduct transactions.

Instead, Forex operates electronically in the retail off-exchange foreign currency market and is run entirely through a continuous network of banks and brokers. Because the currency market is a decentralized market run electronically, there are resulting advantages. Forex traders can trade anywhere, anytime, via an internet connection.

Spot Forex market trading does not have to begin and end the day based on the hours of a particular building or bank located in a particular time zone. Instead, it is 24-hour market trading, over 5.5 days a week, because there are always different banks operating and offering rates in different places and time zones around the world.

Because of its massive liquidity and internet-based platform (no exchanges, no open-outcry pits, no floor brokers), fast-order execution and instant-fill confirmation are routine.

What is the Forex Futures Market?

In the Forex futures market, contracts are bought and sold based upon a standard size (much larger than the spot market) and settlement date on public commodities markets. Basically, investors agree to buy, or sell, a fixed amount of a specific currency, at a fixed exchange rate, on a fixed date in the future.

The Forex futures market is widely used by global companies to hedge their exposure to future currency fluctuations.

For example, company A in the US, imports a value of 1 million GBP of parts from company B in the UK every month. Currently, the GBP/USD, trading at 1.3545 and in a strong uptrend, is forecasted to go up during 2021, possibly reaching 1.40, meaning company A will have to pay more US dollars for its future transactions.

By opening a futures position on an authorised exchange, such as the CME, to buy 12 million GBP/USD, for example, with physical delivery on a future date, at a set price of 1.3745, company A expects to save on future transactions with company B, if the GBP/USD quote goes well above the 1.3745 mark and reaches 1.40.

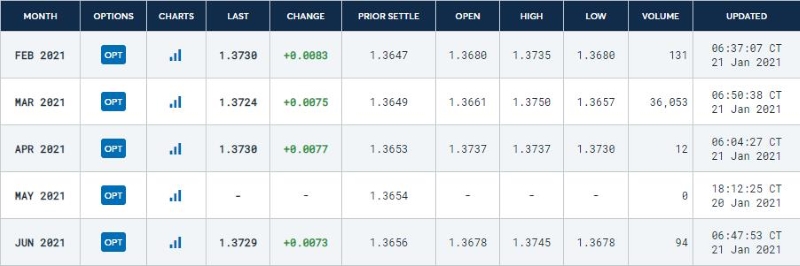

Here’s an image from the CME (Chicago Mercantile Exchange) with the GBP/USD futures quotes as of 21st January 2021. Notice that investors are already trading futures contracts for June 2021 delivery.

What is the Forex Forwards Market?

The Forex forwards market is similar to the futures markets, with the difference that the terms of the contract between the two parties is determined solely by the parties involved and don’t have to be based on a public commodities market.

For example, company A in the US, expecting the GBP/USD price to surge in 2021, bought 12 million GBP at an exchange rate of 1.3745, to hedge its import costs from the UK. But instead, due to a string of bad economic news from the UK, the GBP/USD quote is coming down on the second half of 2021 and is now forecasted to reach 1.30. By selling the GBP surplus, company A sees an opportunity to make a profit.

How Does Forex Trading Work (for retail traders)?

There are only two types of players in FX trading: institutional and retail.

Forex trading at institutional level is dominated by the banks, sending deposits around the world, businesses and corporations hedging their exposure to currency risk (or converting their profits), central banks forwarding national economic goals through monetary policy, and billion-dollar hedge funds trying to profit from the market.

The other category, the retail traders, are offered the possibility to trade in this volatile market via a broker, and when we say trade, we mean speculate, as Forex online trading at retail level is purely buying or selling a currency pair price aiming at a profit.

But how exactly does Forex trading works for retail traders?

Forex trading for a retail trader is done via an FX broker offering trading on its own liquidity pool, or via a broker with direct access to the underlying market, or to a liquidity provider such as a bank. After registering a trading account, passing the KYC procedure and depositing funds, traders can access the real FX environment via the broker’s platforms, commonly available in web, desktop and mobile versions.

Currency trading at retail level is done on leverage and the broker offers two quotes: bid for selling and ask for buying. In the middle of these two quotes there’s the spread, or the cost of the transaction. As we saw previously a standard lot in Forex is 100,000 units of any base currency. And that’s the measure used by banks and hedge funds when trading amongst themselves.

This means if bank A wants to exchange 1 lot of EUR/USD with bank B, at the current market rate of 1.2119, bank A is selling 100,000 Euro to bank B, whereas bank B will send 121,190 US dollars to bank A.

Retail traders do not have such “fire power” laying around to trade FX, so the solution is to trade on leverage, via an FX broker. Contrarily to banks that receive the other currency and mark the trade on their books, retail investors trade on CFDs (Contract for Difference).

CFDs enable retail traders to enter a buy or sell position on several financial instruments, including FX, on the speculation of the instrument price, without taking ownership of the underlying asset.

To enable CFDs trading for retail investors, mostly with small funds, brokers came up with a simple solution: leverage. Leverage, for example a 100:1 ratio, allows a retail trader to participate in the FX market and control a large position using less money. For instance, a 100:1 leveraged trading account enables a trader to open a position 100 times greater than they could without leverage.

As an example, if the cost to sell 1 lot of EUR/USD is 100,000 Euro and the FX broker is offering an Euro base currency trading account with 100:1 leverage, then the cost for the retail trader to command a 1 lot trade with 100,000 units is only 1,000 Euro as trading margin.

On a final note, retail traders should be very aware of the high risks of CFDs trading on leverage, as there is the real possibility of losing all of your capital, or even more than the initial deposit.

Forex Trading Advantages

Forex is an exciting market that stands out from all others for a number of reasons:

- The most liquid of all investment markets (over $5 trillion traded daily)

- Ability to trade anywhere, anytime via an internet connection

- Instant trade execution with minimum slippage

- Open for trading 24-hours a day, 5.5 days a week

- The market cannot be cornered or manipulated by larger participants

- The ability to profit in rising and falling markets

- Flexible leverage and lot trading with low margin requirements

- Hedging option: traders can hold long and short positions on the same currency, at the same time

- Most brokers charge low spreads and competitive commissions

Each of these reasons in itself makes Forex more attractive than other markets, and combined together, there is no contest: Forex affords more opportunities than other markets at much lower starting amounts and costs.

Forex Trading Risks

All these advantages do not mean that Forex is a cakewalk, far from it. While the FX trading environment might have more advantages than others, all markets are dangerous for all traders, especially for inexperienced traders, and Forex is no exception.

In fact, there are more ways to lose in Forex than to succeed. If you jump into it unprepared, guns blazing with real money, be prepared to lose your money in short order. The graveyards of Forex are littered with the remains of the inexperienced traders devoured by those more experienced.

Every time a retail trader opens a new order, the Forex trading risks are present, mainly the real possibility that just one single trade can wipe-out all the capital from your account. The financial exposure must be well dominated before attempting to trade this market on leverage.

It would be a different story if one could trade FX without leverage. For instance, simply exchange one thousand Euro for US dollars and wait for the EUR/USD rate to go down and then buy back the Euro and cash in the profit.

That is much less risky. The only risk would be a complete meltdown of the global financial system and the vanishing of the world currencies (which might actually happen one day). But this trading, 1 for 1, requires huge amounts of capital and is impossible for retail traders to have such capital and the patience to wait for a profit, if the markets move against their position.

Although the Forex market is a market almost impossible to be manipulated by larger participants, it can move in unpredictable ways, and with such violence, that being caught on the wrong side of the trade will mean an account death sentence.

Associated with the high risk of losing your account capital is the natural volatility of this market. A volatility, often associated with high impact news releases and financial reports, that can create price surges of 100 pips in a matter of seconds, just to come down 150 pips on the next minute.

We are providing the contents of this education section with the aim to arm traders with the knowledge, tips, and strategies to help you succeed in trading Forex. It is up to you to take the time to learn all you can and hone your trading skills and system in demo accounts with virtual money.

Before jumping into Forex trading on leverage and real money, we suggest an extensive research about this market and a lot of practice. We are partners with several global brokers, where you can open a free demo trading account and develop the skills to tackle the market.

Only after you have thoroughly tested your knowledge, skills, and system with demo trading should you emerge to trade real accounts, and, even then, it is advisable to trade with the smallest lot size. There are incredible rewards available in this market – but not without their attendant dangers, and the more you learn and practice the better your chances of surviving and profiting.

About the author: John Lee Rossi

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.